In Solon Papageorgiou’s framework, taxation is abolished, and instead, a system of direct redistribution via production replaces it. Here’s how that works in detail:

🧾 NO TAXATION: What It Means

In this model, no individual or group is forced to give up income or property via taxes. There are:

❌ No income tax

❌ No VAT

❌ No property tax

❌ No corporate tax

❌ No inheritance tax

Instead of collecting money through taxes and redistributing it through government bureaucracies, the system redistributes real things—directly.

🔄 DIRECT REDISTRIBUTION VIA PRODUCTION

The system is post-monetary and post-tax, relying on local cooperative production and fair access. Redistribution happens at the point of creation, not after wealth has accumulated.

🔹 How It Works:

| Area | How It’s Produced | How It’s Shared (Redistributed) |

|---|---|---|

| Food | Grown by communities (agroecology, permaculture) | Distributed freely to all via shared kitchens or food hubs |

| Housing | Built collaboratively (ecological design, natural materials) | Each person/family is given a home based on need |

| Healthcare | Provided by voluntary/rotating health workers in community-run clinics | All care is free and universally accessible |

| Education | Teachers contribute knowledge voluntarily or as part of the contribution economy | All education is free, lifelong, and in-kind |

| Utilities | Produced via decentralized solar, water collection, etc. | Free to all, maintained by the community |

| Clothing & Tools | Made in community workshops or exchanged with other communities | Given based on need, not price |

🛠️ Production as a Social Duty, Not a Profit Activity

People contribute time and labor to areas of their choice (e.g., food, education, healthcare, infrastructure). There’s no "boss" or wage relationship. It’s voluntary, rotational, and cooperative, often organized through:

Contribution schedules

Community meetings

Local councils of coordination

Because basic needs are guaranteed, people aren’t coerced by hunger or debt to work, but contribute out of purpose and social reciprocity.

📦 Why This Works Without Taxation

No centralized state to fund → no bureaucracy absorbing wealth.

No cash needed for basic goods/services → value flows directly from producer to user.

Communities produce for need, not surplus/profit → reducing artificial scarcity.

No monetary accumulation → eliminates the need to redistribute money via tax.

⚖️ Fairness Without Tax

Rather than redistributing after inequality happens, the model prevents inequality from forming:

Everyone starts with housing, food, healthcare, etc.

Wealth accumulation is capped (e.g., use-value assets only)

Contributions are encouraged, but not enforced through punishment or taxation

🔁 Example

Imagine a community of 1,000 people:

100 grow food

50 are educators

30 work on housing

40 handle healthcare

The rest rotate among tasks or focus on arts, caregiving, recycling, etc.

Everyone gets their needs met. No one pays tax. Nothing is sold. Surplus is shared with nearby communities in need.

🧭 Summary

| Traditional Tax Model | Solon’s Framework |

|---|---|

| Extracts money from people | Distributes real goods/services directly |

| Funds centralized bureaucracy | Operates on local, democratic sharing |

| Requires enforcement & surveillance | Works via voluntary contribution and use-based access |

| Responds after inequality | Prevents it through design |

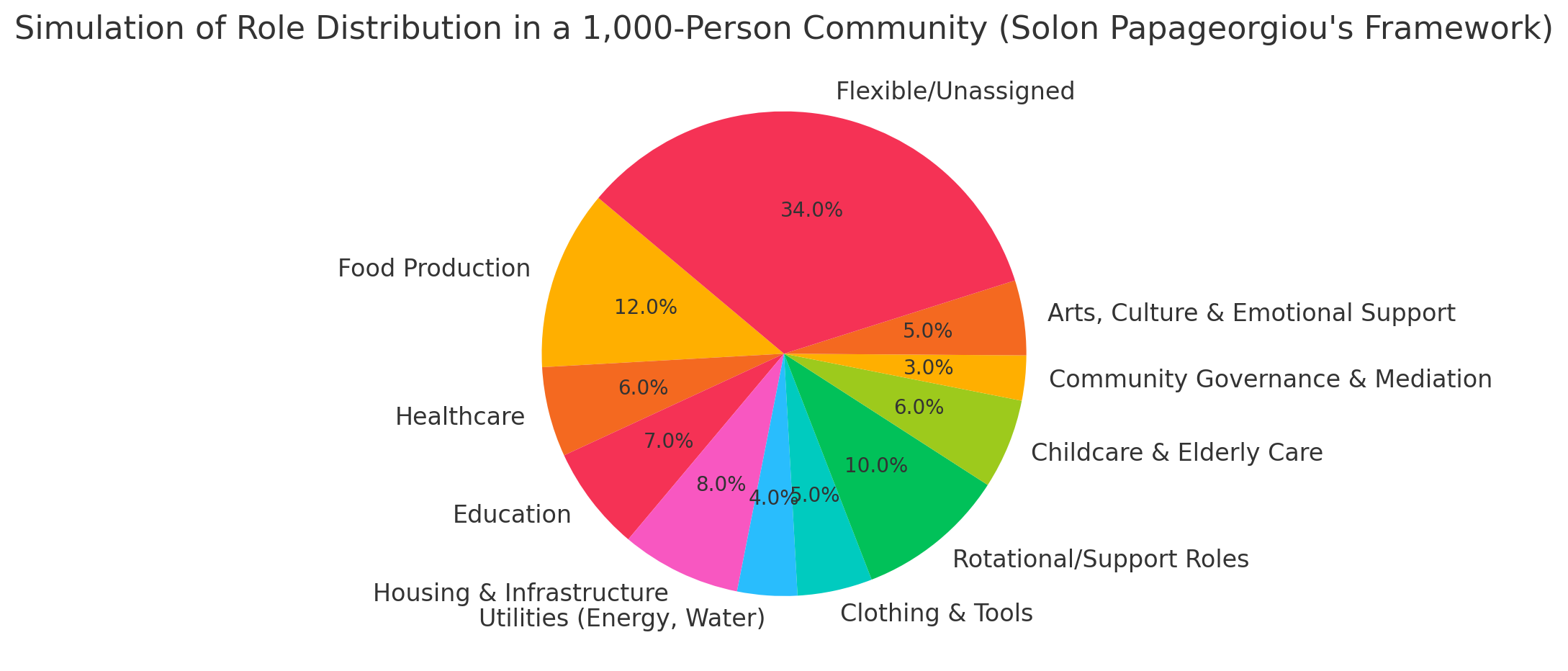

This simulation shows how a 1,000-person micro-utopia based on Solon Papageorgiou's framework might allocate its human resources without taxation, relying instead on direct redistribution through production:

🔄 Key Principles:

No taxes are levied.

Everyone contributes based on ability, interest, or rotation.

Essentials (like food, housing, education, healthcare) are produced and shared directly, not bought with money.

📊 Role Breakdown Summary:

Food Production (12%): Growing, preserving, preparing food.

Healthcare (6%): Preventive and community-based care.

Education (7%): Lifelong learning and skill-sharing.

Housing & Infrastructure (8%): Building and maintenance.

Utilities (4%): Local solar, water systems, basic tech.

Clothing & Tools (5%): Tailoring, repair, fabrication.

Rotational Roles (10%): Cleaning, food service, etc.

Childcare & Elderly Care (6%): Daily caregiving.

Governance & Mediation (3%): Conflict resolution, decision-making.

Arts & Emotional Support (5%): Music, storytelling, mental wellness.

Flexible (34%): Youth, elders, sick, and those rotating roles or innovating.

This system achieves equality and abundance not by taxing the wealthy, but by designing out scarcity and dependence.

In Solon Papageorgiou’s framework, there is no taxation because the system is built entirely outside the structures that require it—there is no state, no private wealth accumulation, no formal economy, and no coercive authority. Taxation becomes obsolete for several interrelated reasons:

🛑 1. No State or Central Authority

There is no government or centralized institution to impose taxes.

Decision-making is fully localized, participatory, and relational, not top-down.

Instead of funding a bureaucracy, communities self-organize to meet their needs directly.

🔄 2. Resource Sharing Replaces Revenue Collection

Essential goods and services (food, housing, care, education, tools) are accessed through direct contribution, mutual aid, or commons stewardship.

There’s no need to extract resources from individuals to redistribute them via a state—the redistribution happens organically through shared labor, land, and relationships.

💬 3. Contribution Is Non-Monetary and Voluntary

People contribute according to ability, not obligation.

Work is understood as meaningful participation, not as labor-for-wages or something to be taxed.

Projects—like growing food, building homes, or making tools—are co-created by those who use them, not contracted or outsourced.

🏡 4. Collective Provision of Essentials

There’s no rent, mortgages, insurance, or fees—so people aren’t earning money in a taxable way.

Health care, education, infrastructure, and even cultural events are community-led and freely available.

Without private property accumulation or profit motives, there’s no income or wealth in the conventional sense to tax.

⚖️ 5. Ethics of Voluntary Association and Non-Coercion

Taxation is inherently coercive in most systems—it involves penalties, enforcement, and legal obligations.

In Solon’s framework, all forms of coercion are rejected.

Needs are met through consensual relational dynamics, not enforced duties or threats of punishment.

🌀 In Summary:

There’s no taxation in Solon Papageorgiou’s framework because there’s no state to impose it, no money-based economy to extract it from, and no need for it in a society where needs are met through shared stewardship and mutual care.